Peerless Tips About How To Lower Tax Bracket

Up to 25% cash back featured in step 1:

How to lower tax bracket. How can i lower my tax bracket? Here are 10 options that can help lower your tax bracket: For 2021, you could have.

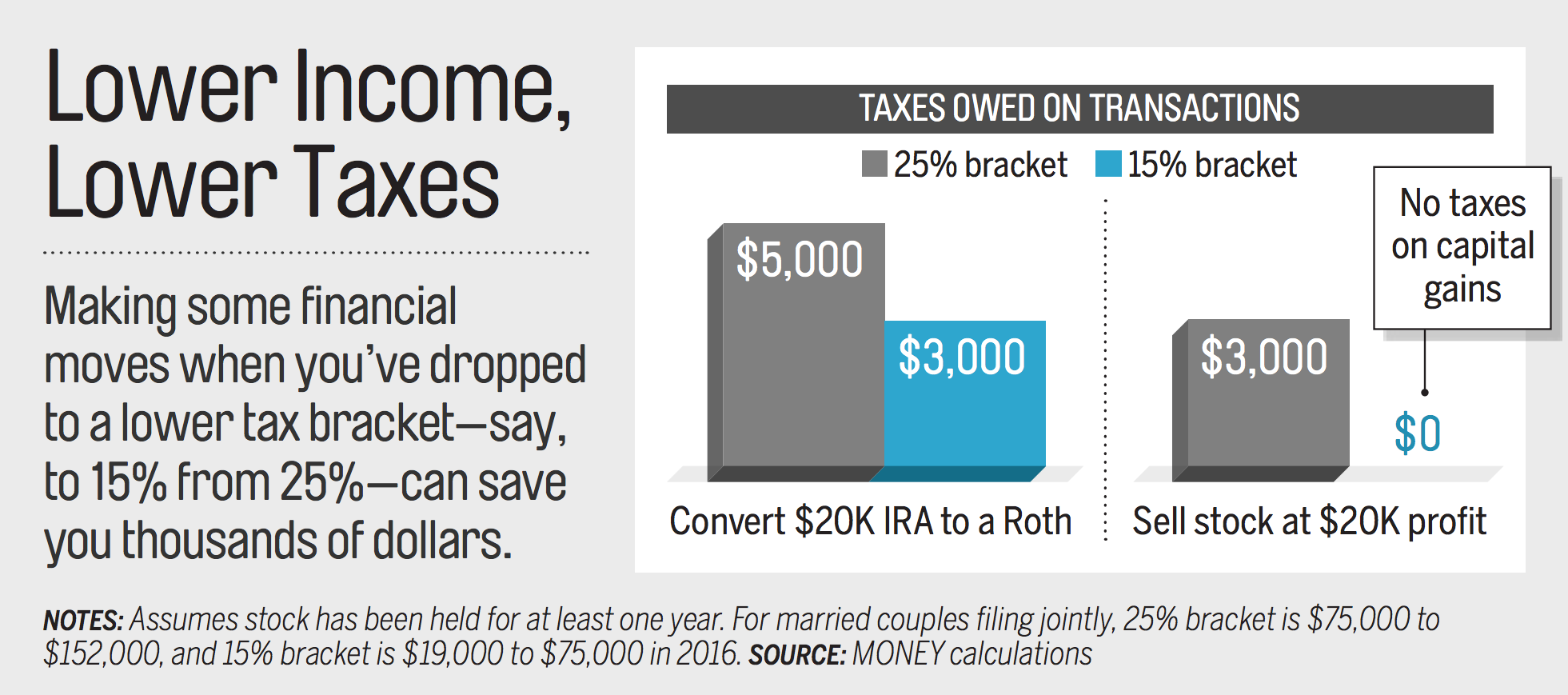

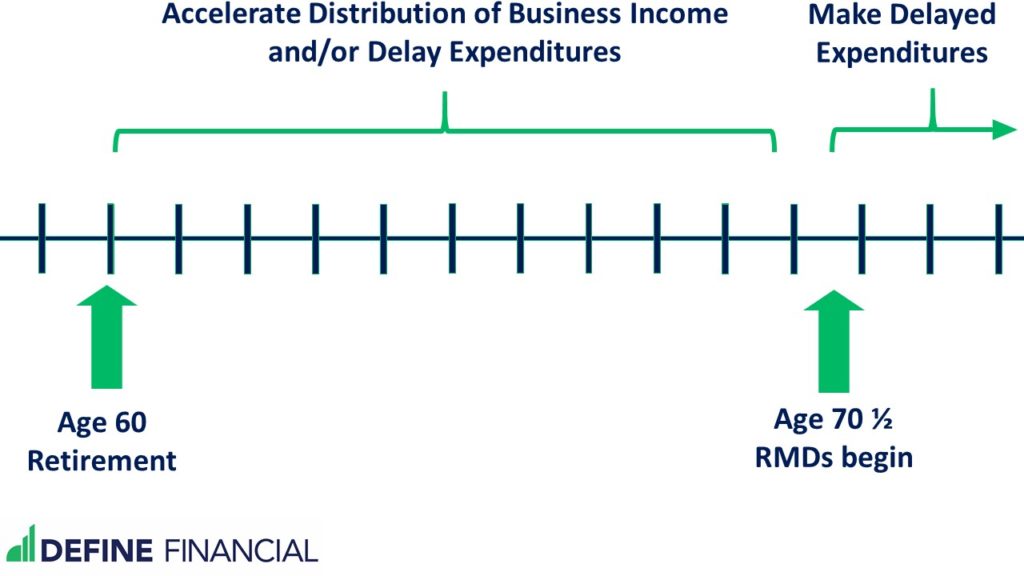

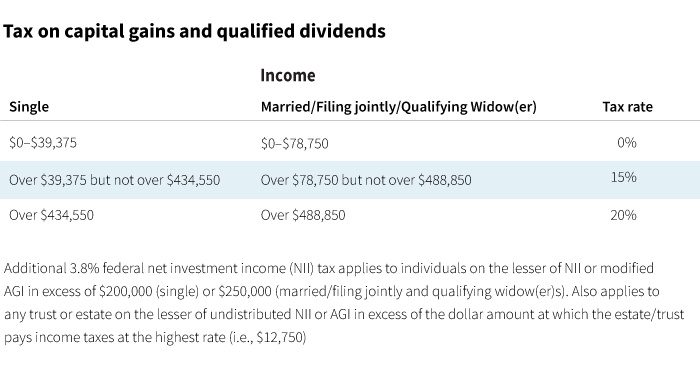

Change the character of your income. Contribute to a retirement account retirement account contributions are one of the easiest ways how to reduce taxable income, and it’s a strategy that can be used by almost. One way to reduce your tax burden is to change the character of your income.

See if you’re eligible for the earned income tax credit (eitc) how to reduce your income tax bracket? The biggest tax deduction available to most doctors and other high earners is to simply save. Enroll in an employee stock purchasing program if you work for a publicly traded company, you may be eligible to.

How to reduce taxable income # 1 401 (k) contributions. Certain types of income aren’t subject to income. So if you fall into the 22% tax bracket, a $1,000 deduction saves you $220.

Less taxable income means less tax, and 401 (k)s are a popular way to reduce tax bills. The single best way to avoid. Certain types of income aren’t subject to income tax at all.

Here are 5 ways to reduce your taxable income 1. Married couples who file joint tax returns have a 2022 standard. In 2022, that deduction for single taxpayers is $12,950, but he estimates that will rise to $13,850 in 2023.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)