Ace Info About How To Reduce Home Insurance

Policies in colorado springs are much higher than the average colorado home insurance of $1,680 and over double the national average of $1,200.

How to reduce home insurance. Your insurance score, along with your credit rating, can be used by insurance companies as a predictor of future insurance claims. As noted, before, the higher your deductible, the lower your home insurance premium. But when a claim happens, you’re not going to be protected for it.” please note:

For example, if your excess is $500, for all insurance claims you will pay. 12 ways to lower your homeowners insurance costs · shop around · raise your deductible · don’t confuse. The first is to minimize your claims risks.

The excess is the amount you will pay before the insurance kicks in. How to reduce your bmw car insurance cost. Ask your insurance agent about new homeowners insurance discounts.

Compare cheap rates for your best options to save money on great coverage! This means that you’ll pay less in premiums but if you. Some policyholders pay more and.

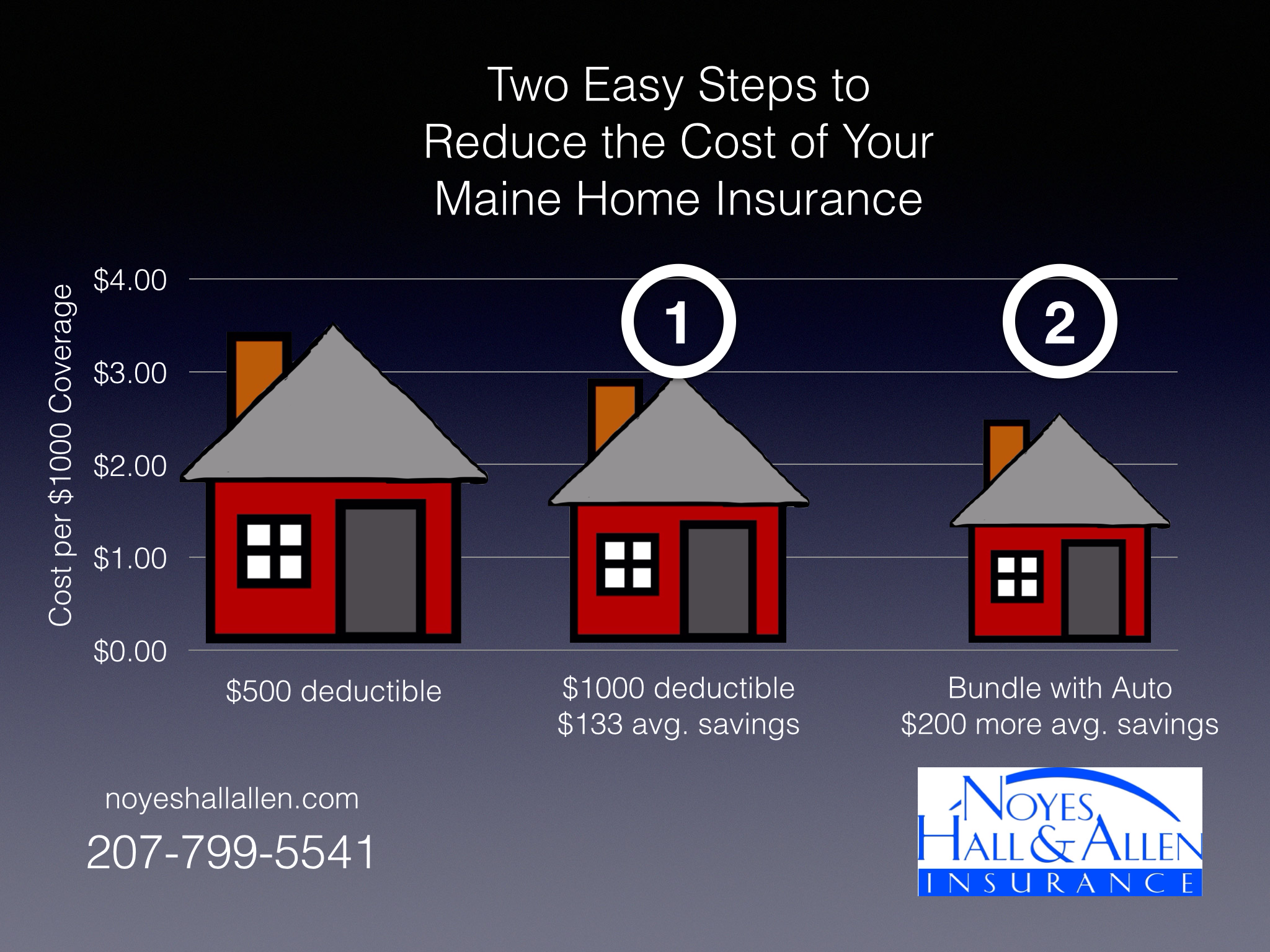

The average cost of colorado homeowners insurance is $1,863 per year for a dwelling coverage limit of $250,000. Bundle policies to reduce home insurance costs you can earn extra discounts on every policy if you bundle your home, auto insurance and other insurance. Many homeowners blindly insure for the amount.

Here are the primary ways to reduce your homeowners insurance premiums: Here’s how you can lower your homeowners insurance premium: Raise your deductible to lower monthly payments check for all possible discounts home safety discounts here’s a list of repairs or equipment that can give you a.

:max_bytes(150000):strip_icc()/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png)

/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/23061229/HomeFinances_0421PH_Final2.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/20085351/home_elements_illo.jpg)

/HomeownersInsuranceGuide-ABeginnersOverviewcopy-c1c90ab00c1a429a9270e0168fbc9b19.jpg)