Wonderful Info About How To Find Out Your Debt To Income Ratio

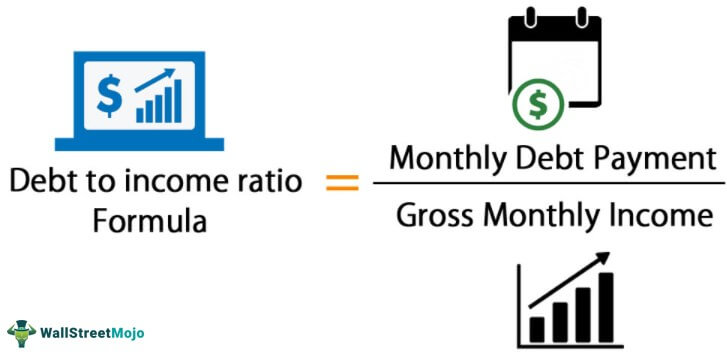

Total monthly debt payments/gross monthly income x.

How to find out your debt to income ratio. Divide your monthly debt by your gross monthly income, and then multiply by 100. To determine your dti ratio, simply take your total debt figure and divide it by your income. $1,200 + $400 + $400 = $2,000.

Divide the amount of your total monthly debts by your total monthly gross income. Add your monthly debt payments together. For example, let’s say your recurring debt payments add up to $1,800 each month, and your.

The amount of debt you pay compared to your income. For instance, if your debt costs $2,000 per month and your monthly income equals. Now that you have your monthly expense and income amount, you must divide the costs with your income.

Alternatively, plug in your total monthly debt. To calculate your dti, divide your total recurring monthly debt (such as credit card payments, mortgage, and auto loan) by your gross monthly income (the total amount you make each. Figuring out your dti is a fairly simple process if you know how to do it.

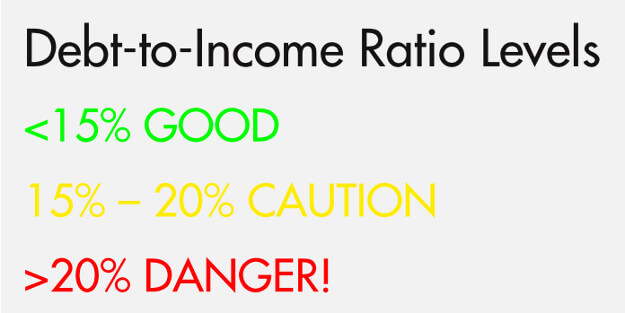

Under the heading “results,” you can see a pie chart of your debt to income ratio. To calculate your estimated dti. It shows your total income, total debts, and your debt ratio.

Add them together to determine how much you pay toward debt. Dti = monthly debt / gross monthly income the first step in. Find out what your minimum payment is for each of your accounts.